Blockchain Technology Essays: Cryptocurrency Use Cases

The Revolutionary World of Blockchain

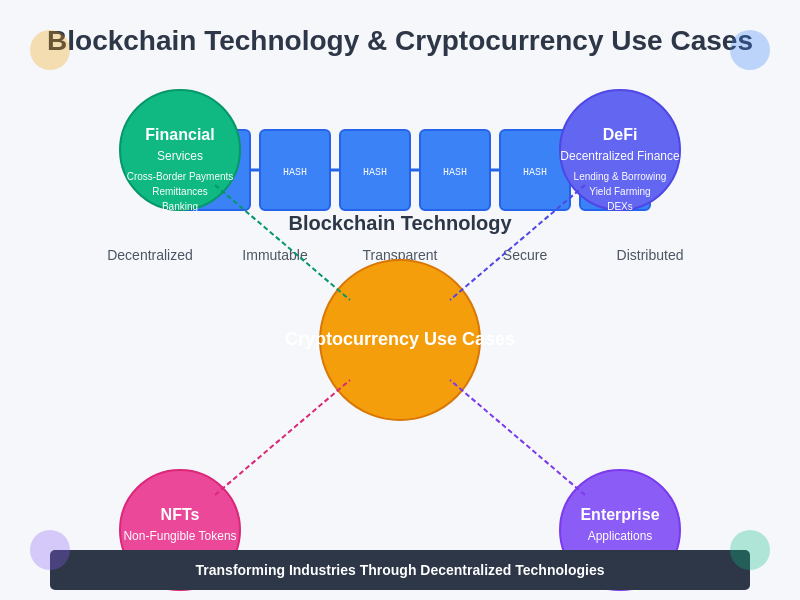

Blockchain technology has fundamentally transformed how we think about digital transactions and data security. Originally designed as the underlying structure for Bitcoin, blockchain has evolved far beyond cryptocurrency to revolutionize industries ranging from finance to healthcare. This decentralized ledger technology offers unprecedented security, transparency, and efficiency—creating a foundation for the next wave of digital innovation. Today, we’ll explore how cryptocurrency applications have become the most visible implementation of blockchain, transforming everything from personal finance to international trade.

What Is Blockchain Technology?

Blockchain technology is a distributed, immutable ledger system that records transactions across multiple computers. Unlike traditional centralized systems, blockchain creates a chain of data “blocks” that are chronologically linked and cryptographically secured. This structure makes the recorded information virtually tamper-proof, as altering any single block would require changing all subsequent blocks across thousands of computers simultaneously.

How Does Blockchain Work?

The core functioning of blockchain involves several key components:

- Distributed Ledger: All participants (nodes) have a complete copy of the entire transaction history

- Consensus Mechanisms: Methods like Proof of Work (PoW) or Proof of Stake (PoS) validate transactions

- Cryptographic Security: Advanced encryption protects data integrity

- Smart Contracts: Self-executing contracts with terms directly written into code

| Blockchain Component | Function | Example |

|---|---|---|

| Nodes | Maintain copies of the blockchain | Miners, validators |

| Blocks | Containers for batched transactions | Bitcoin blocks contain ~1-3MB of transactions |

| Consensus Algorithms | Validate new transactions | Proof of Work, Proof of Stake |

| Hash Functions | Create unique fingerprints for data | SHA-256 |

| Smart Contracts | Self-executing code agreements | Ethereum smart contracts |

Blockchain’s innovative architecture makes it ideal for applications requiring high security, transparency, and immutability—leading to its widespread adoption across various industries.

Cryptocurrency: The First Major Blockchain Use Case

Cryptocurrency represents the original and most widespread application of blockchain technology. Bitcoin, created by the pseudonymous Satoshi Nakamoto in 2009, introduced the concept of a peer-to-peer electronic cash system that operates without central authority.

Key Cryptocurrency Use Cases

1. Digital Payments and Money Transfers

Cryptocurrencies have revolutionized how we send and receive money, particularly for international transfers. Traditional cross-border payments often involve multiple intermediaries, high fees, and processing times of 3-5 business days. Cryptocurrency transactions can settle in minutes or seconds, regardless of geographical boundaries.

Financial institutions like JP Morgan have developed their own blockchain-based payment systems, recognizing the efficiency advantages over traditional SWIFT transfers. The JPM Coin facilitates instantaneous transfers between institutional clients, demonstrating how even established financial giants are embracing blockchain technology.

2. Store of Value and Inflation Hedge

Bitcoin has increasingly been adopted as a store of value or “digital gold.” In countries experiencing high inflation or currency instability, cryptocurrencies offer an alternative to devaluing local currencies. This has proven particularly valuable in regions like Venezuela, Argentina, and Zimbabwe, where citizens have turned to Bitcoin as a means of preserving wealth.

| Country | Inflation Rate (Recent High) | Bitcoin Adoption Increase |

|---|---|---|

| Venezuela | >1,000,000% (2018) | 450% increase in trading volume |

| Argentina | >50% (2021) | 320% increase in wallet creations |

| Zimbabwe | 500% (2020) | 150% increase in P2P trading |

3. Decentralized Finance (DeFi)

Decentralized Finance represents one of the most innovative cryptocurrency use cases. DeFi applications leverage smart contracts to recreate traditional financial services without intermediaries. These include:

- Lending and borrowing platforms like Aave and Compound

- Decentralized exchanges (DEXs) like Uniswap and SushiSwap

- Yield farming opportunities allowing token holders to earn passive income

- Stablecoins providing price stability in the volatile crypto market

The DeFi ecosystem has grown from under $1 billion in total value locked (TVL) in early 2020 to over $100 billion at its peak, demonstrating the enormous potential for blockchain-based financial services.

4. Non-Fungible Tokens (NFTs)

NFTs have created entirely new markets for digital ownership and creative expression. These unique digital assets represent ownership of specific items—from digital art and music to virtual real estate and in-game assets. The NFT market experienced explosive growth in 2021, with some collections like CryptoPunks and Bored Ape Yacht Club seeing individual pieces sell for millions of dollars.

Beyond digital art, NFTs are being used for:

- Event ticketing with built-in royalties for resales

- Intellectual property rights management

- Gaming assets that can be transferred between platforms

- Digital identity verification

Enterprise Blockchain Applications

While cryptocurrencies garner significant attention, businesses are implementing blockchain solutions for numerous operational purposes that don’t necessarily involve digital currencies.

Supply Chain Management

Blockchain technology provides unprecedented transparency and traceability throughout complex supply chains. Companies like Walmart and Maersk have implemented blockchain solutions to track products from origin to consumer, addressing issues like:

- Food safety and rapid contamination source identification

- Counterfeit product detection

- Ethical sourcing verification

- Inventory management optimization

Walmart’s food traceability initiative reduced the time needed to trace mangoes from store shelves to farm origin from 7 days to 2.2 seconds, demonstrating blockchain’s transformative potential for supply chain management.

Healthcare Records and Data Management

The healthcare industry is leveraging blockchain to address critical challenges in medical record management:

- Secure patient data sharing between providers

- Immutable medical history records

- Prescription tracking to combat fraud and abuse

- Clinical trial data integrity

MedRec, developed by MIT researchers, exemplifies how blockchain can improve healthcare data management while maintaining patient privacy and control over personal information.

| Healthcare Blockchain Application | Benefit | Example Implementation |

|---|---|---|

| Medical Records Management | Secure, patient-controlled access | MedRec, Medibloc |

| Pharmaceutical Supply Chain | Counterfeit prevention, temperature monitoring | Mediledger, VeChain |

| Clinical Trial Management | Data integrity, patient consent management | Blockpharma, Embleema |

| Insurance Claims Processing | Fraud reduction, administrative efficiency | Gem Health, Change Healthcare |

Challenges and Considerations in Blockchain Implementation

Despite its transformative potential, blockchain technology faces several significant challenges:

1. Scalability Issues

Many blockchain networks, particularly those using Proof of Work consensus mechanisms, face scalability limitations. Bitcoin can process approximately 7 transactions per second (TPS), while Ethereum manages around 15-30 TPS. By comparison, Visa’s network can handle over 24,000 TPS. Solutions being developed include:

- Layer-2 scaling solutions like Bitcoin’s Lightning Network

- New consensus mechanisms such as Proof of Stake

- Sharding to distribute network load

- Sidechains for specialized functionality

2. Regulatory Uncertainty

The regulatory landscape for blockchain and cryptocurrencies remains in flux globally. Different jurisdictions have taken varying approaches, from embracing innovation to imposing strict limitations. Key regulatory considerations include:

- Securities regulations for token offerings

- Anti-money laundering (AML) compliance

- Know Your Customer (KYC) requirements

- Tax implications of cryptocurrency transactions

Regulatory clarity is essential for broader institutional adoption of blockchain technology and cryptocurrency applications.

3. Energy Consumption

Proof of Work blockchain networks, particularly Bitcoin, have faced criticism for their significant energy consumption. Bitcoin mining alone consumes more electricity than many countries. The industry is responding with:

- Transition to Proof of Stake (Ethereum’s recent merge)

- Renewable energy mining operations

- Carbon offset initiatives

- More energy-efficient consensus mechanisms

The Future of Blockchain Technology

Blockchain technology continues to evolve rapidly, with several emerging trends shaping its future:

Interoperability Between Blockchains

Projects like Polkadot and Cosmos are developing frameworks to enable communication between different blockchain networks, addressing the current fragmentation in the ecosystem. This interoperability will be crucial for creating a seamless web of blockchain applications.

Central Bank Digital Currencies (CBDCs)

More than 80% of central banks worldwide are exploring digital currencies. China’s Digital Yuan is already in advanced testing stages, while the United States, European Union, and other major economies are accelerating their CBDC research. These government-backed digital currencies will leverage blockchain technology while maintaining centralized control.

Web3: The Decentralized Internet

Web3 represents the vision of an internet built on blockchain principles, where users control their data and digital identities rather than relying on centralized platforms. This ecosystem includes:

- Decentralized social media platforms

- Data marketplaces where users can monetize their information

- Self-sovereign identity solutions

- Decentralized autonomous organizations (DAOs) for community governance

FAQs About Blockchain Technology and Cryptocurrency Use Cases

Blockchain is the underlying technology—a distributed, immutable ledger system—while cryptocurrencies are digital assets that use blockchain for secure transactions. All cryptocurrencies use blockchain, but blockchain has many non-cryptocurrency applications in supply chain, healthcare, and more.

The legal status of cryptocurrencies varies by country. Some nations have fully embraced them, others have imposed restrictions, and a few have banned them entirely. Most developed economies allow cryptocurrency use but are developing regulatory frameworks to address concerns around taxation, consumer protection, and financial stability.

Blockchain is extremely secure due to its distributed nature and cryptographic foundations. While no system is entirely unhackable, successfully attacking a well-established blockchain would require controlling the majority of the network’s computing power (known as a 51% attack), which is prohibitively expensive for major networks like Bitcoin and Ethereum.

Financial services have seen the most immediate impact, but supply chain management, healthcare, real estate, government services, and intellectual property management are all experiencing significant blockchain innovation. Any industry requiring secure, transparent record-keeping can potentially benefit from blockchain technology.

Traditional Proof of Work blockchains like Bitcoin consume significant energy. However, newer consensus mechanisms like Proof of Stake use up to 99.9% less energy. Additionally, many mining operations are transitioning to renewable energy sources, and carbon offset programs are becoming more common in the industry.